[2/10] How to build a growth roadmap

Understanding metric hierarchy, independent metrics, and OKRs

Welcome to the 2nd essay of the 10-part series, Firestarter, on the set of skills to lead growth function.

In the previous essay, we went about turning a business idea into its growth formula, and then building its growth model. In this one, the objective is to translate the high-level growth model into an actionable growth roadmap.

Input metrics versus output metrics

“You do not rise to the level of your goals. You fall to the level of your systems.” Goes the famous James Clear quote. For example, reading a book every month is a goal. Reading 10 pages of a book, just before bedtime everyday, is a system. We don’t fail to read a book a month; we fail to read 10 pages every night. And this idea extends to matters beyond individual productivity too.

Companies generally have clarity on their overarching goal – that one lofty number to rally the troops around. Such as, getting to 1 million active users, or 1 million lifetime customers, or 100 million transactions per month. And, rightly so, since just having one clear goal gives a simplifying clarity of that one thing that really matters. Magnitude of the number energizes the team.

But goals are outcomes of things people do, not something people work on as tasks. You read 10 pages before bedtime, and the book gets finished as an outcome. Similarly, the goals that businesses take up are not something they work on, on an hourly basis; the goals get achieved as a result of the right input tasks/levers being worked on.

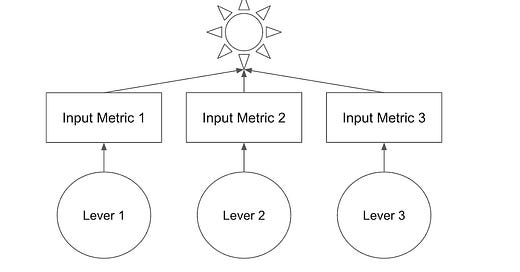

This is all to say: yes, a business needs to be clear on what the ultimate goal or their north star metric is. But, they also need to realize it is but an output/dependent metric. They need to know the input/independent metrics that make up the output metric. And what are the levers that need to be worked on to move the needle on the input metrics. Let’s understand these with an example.

Suppose we have launched a new online-only restaurant, which has become a runaway success. Every morning we check the sales numbers, and, sure enough, the numbers are always going up and up.

Except one day when it is not. And then the trend continues for a week. The number is now consistently trending down. Why is it happening, we wonder? But we don’t know the reason for why it is decreasing because maybe we never really understood why it was increasing either.

The sales numbers are an output metric, yes. So, what are the input metrics? That is, if we had to write a formula for it, what would be on the right hand side of this equation: Sales = ?

We think about it, for a bit, and the formula that has all the independent input metrics that make up sales is:

Now, suddenly we have a headway: if sales numbers as output metric are trending down, then one (or more) of the input factors on the right have to be going down too.

Suppose we find out that traffic is the same as before, and conversion seems to be fine too. Which means it must be the average order value that is trending down. And so, if we just fix that number, the output metric will be back on track too. But wait, how do we fix it?

We can go about fixing a number only if we know what makes up that number. And so, once again, we have to think of the formula that makes it up:

Average Order Value = Average items bought per purchase * Average item price

So, we dig in once again to figure what’s happening? Are people buying fewer items? Or are they buying the same number of items but the less costly ones? We find out it’s the former and in order to fix this input metric, we pick up a lever. Say, prepare a better cross-sell plan to induce customers to buy more items together in a purchase. While picking up the right levers is, in itself, a combination of scientific and creative thinking, and one entire section in this series (essays #4-7) is dedicated to it, the point of this example is to demonstrate how we went from the output metric of sales numbers to its input metrics, and then one-level deeper further, to finally arrive at a lever i.e. an activity that can be actioned on.

But, wait! Did we not decide that average order value was an input metric which influences the output metric of sales? Now we are saying it is, in fact, an output metric itself, influenced by other input metrics. Welcome to the concept of hierarchy of metrics.

Going back to the reading example: we defined the number of pages read per day as the input to the number of books finished as an output metric. The same concept extends there too. Once we move the magnifying glass over “number of pages read per day”, it can be broken down into three components: duration of time the book was open, % of time we were focussed, reading speed of words per minute of focussed time. So, the number of books read in a year might be the ultimate output metric (the north star metric, that is; should it be the NSM is an altogether different matter), then comes a bunch of input metrics which build to that number, and which might be output metrics themselves.

We will expand upon this hierarchy of metrics again in this essay as well as the subsequent essay on setting up a continuous measurement system. For now, the key takeaway is this: a business needs to know its output metrics, the respective input metrics, and the levers to move the independent metrics.

Input & Output Metrics in Growth Model

Now, let’s combine the ideas from the previous section with ideas from the previous essay. But, with a different example.

Suppose we are starting a mobile game app business, which will make money by serving ad impressions to the user. We write down its growth formula. We think of the ideal customer profile and estimate the number of potential users. We put down an estimate of net value per user which we have to validate with real data once the business is operational.

Let’s say the estimates are:

Potential users = 10 million

Net value per user = 10 dollars = 12 dollars lifetime value (LTV) minus 2 dollars of customer acquisition cost (CAC)

How did we arrive at an estimate of LTV? Well, it’s again all about breaking down the output/dependent metric into its input/independent parts. In this case:

Lifetime Value per customer =

Avg. value we got per customer in their 1st month of using the app +

Avg. value we got per customer in their 2nd month of using the app +

Avg. value we got per customer in their 3rd month of using the app + …

And, how do we calculate the average value per customer in, say, the 3rd month of using the app? Let’s say we started with 100 users, and by month-3, only 20 of them are opening the app (i.e % of active users – retention). But the ones who are active, open it 10 times per month on average (i.e. number of sessions or app opens per active user – engagement), and every time they open the app they get served 4 ads (i.e. number of ad impressions per session – monetisation).

So, total ads served in 3rd month = 20 * 10 * 4 = 800

Thus, average ads served in 3rd month per user = 800 / 100 = 8

And, if ad networks pay us $0.1 per ad serve, net value per user in month-3 = $0.8

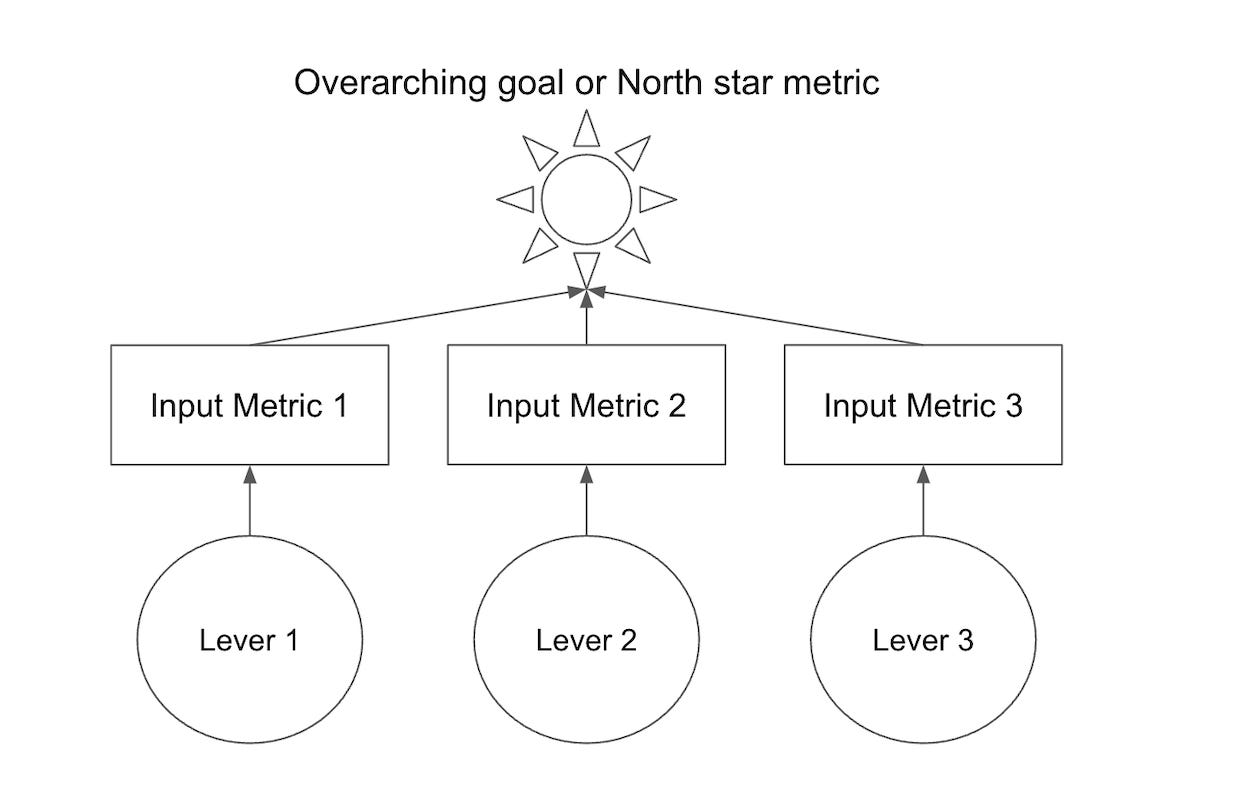

Putting it all together, a hierarchical breakdown emerges:

Now, we have to turn this into a growth model by adding the dimension of time. In the previous essay, we had taken an example of an enterprise software business with very few customers and very high LTV, and so we had prepared the growth model at customer level. In this case, however, since the calculation will run into millions of rows, we will combine customers acquired in the same month into a cohort. Also, we will track the value per customer monthly, instead of annually, considering the lifecycle of a user might not extend beyond a year and might differ significantly between months (weeks even).

With estimates for all input metrics, let’s say, this is what the forecasted growth model comes to:

If we map this to calendar months – month-1 for customers acquired in Jan-24 cohort will be Jan-24, month-2 for this cohort will be Feb-24, month-3 for this cohort will be Mar-24, for example, and similarly month-2 for Feb-24 cohort will be Mar-24, and so on – the previous table transforms to:

[Try replicating this calculation in a sheet. Better still, replicate this calculation for a different business idea altogether.]

Now, let’s say that the company becomes operational with this growth model and aims for 1000 new customers in Jan-24, 1500 new customers in Feb-24, and 2000 new customers in Mar-24, and targets a net revenue of $15,800 as per this model. However, the revenue for Mar-24 is different than was projected in the above table. How do we track the root cause of difference between the projected and actual numbers?

We can look into what were the input metrics for net revenue (see hierarchy of input metrics in the image above) and see where the divergence is. If the difference is in, say, value per customer in month-2 (actual value of $1.7 instead of projected value of $2.0) as input metric, we can look for the independent metrics that compose this number.

So far, we have tried to understand what input and output metrics are, how metrics are part of a metric hierarchy (where input metrics are themselves made of other metrics), and how these concepts fit with the concepts of growth formula and growth model, to help us put together a mathematical model of the business.

But we had started this article with the premise that such a quantitative understanding of a business will translate into an actionable roadmap of tasks & activities to be done to drive growth of the business. Let’s get to that.

Objectives & Key Results: Connecting Growth Model to Growth Team Structure

There is an anecdote of a guest of Elon visiting SpaceX, stopping by an employee on the floor impromptu, and asking them what they were working on. The employee, instead of just telling the task that they were working on, started with SpaceX’s mission of making interplanetary travel possible, what one of many technical challenges in achieving that objective was, and how the specific project they were working on was going to solve it.

The purpose of any goal-setting framework like OKR (Objectives and Key Results) is precisely this. To give an edifying clarity of: What is the long term goal, how will we know if that goal has been achieved, and what do we need to do to make that happen?

Let’s connect our growth model and the concept of OKRs, with the example from the previous section. Let’s say that the company has set the objective of being the most popular mobile game app in the world in the trivia category. Okay, the why is clear. But it’s not very quantitative, which will be brought in by the Key Results part. Which is where the Growth Formula and Growth Model comes in.

In the long run, as per the growth formula, having 10 million customers, each giving $10 of net value are the key results. In the short run, as per the growth model, getting to a net revenue of $15,800 by the third month of the operation is the key result.

To achieve this short-term key result, we will have to achieve different input metrics:

number of customers to be acquired,

customer acquisition cost,

revenue retention in subsequent months (i.e. revenue coming from Jan-24 cohort customers in Feb-24 and Mar-24; revenue coming from Feb-24 cohort in Mar-24).

The metrics hierarchy then maps to the key results hierarchy, which, in turn, informs the growth team’s structure, goals, and tasks. Let’s understand this point, since it connects what we've learned so far, and is the key point of this essay.

The organization has the overarching goal of net revenue, which might be the CEO’s key result. The input metrics for it are number of customers, cost, and revenue retention. The CEO will assign one or more of these metrics to the functional leaders. Let’s say that revenue retention metrics have been assigned to the Head of Growth. They then break down this key result, as per the metric hierarchy in the diagram above, into % of active customers (retention), # of sessions per active user (engagement), and impressions served per session (monetisation), and assigns each of them to respective teams. The person in-charge of user engagement might break it further down into input metrics, and so on. We can visualize it so:

So, is it input metrics all the way down? Where do we hit the bottom of the well? And, how do we make the magical leap from key metrics to levers?

Generally, after 2-3 levels of going down the metric hierarchy, we might reach a reasonably independent metric. Let’s understand this point with the online restaurant example. We started with an overarching goal of sales. Going down the metric hierarchy, at level 1, we get the key metrics of traffic, conversion rate, and average purchase value, which when combined give us the sales numbers. Following conversion rate as a branch, we get, at level 2, % of visitors who view at least one item, % among them who add to cart, % among them who complete the checkout process.

Now moving focus on the ‘% of visitors who view at least one item’, we can further dice it in different ways, but we have perhaps reached that point where instead of figuring out the mathematical formula for it, we can put down the business drivers for it. What could be the drivers for increasing the % of people who reach the online restaurant listing page and click on at least one item? Or inversely, what could be the drivers for decreasing the % of people who don’t click on even one item and bounce off? Perhaps, the page load speed on the technical side. On the merchandising side, it would perhaps be the popularity of the products being displayed up front. What other driver can you think of?

And finally, we pick up the levers that will improve these drivers of the independent metrics. Such as, improving page load speed from x to y; or adding so-and-so popular dishes to the assortment. This leap from the hierarchy of key metrics to a list of levers/activities to be done, to grow the business, thus comes from a deep understanding of the business drivers for the independent metrics. And this understanding can come from diverse sources: customer research, domain experience, data, and, of course, first principles thinking.

Putting it all together, the templated way to understand the relationship between objectives, key results, and levers would be: We want to do x (objective), as measured by y (key result), by doing z (lever).

For example, I want to be well-read, as measured by reading 12 books in 2023, by reading 10 pages every night before bedtime. Or, I want to be healthy, as measured by improving my body mass index to 20, by eating healthy on 90% of the days (lever #1) and exercising for 30 minutes on 80% of the days (lever #2). Levers are something you work on. Metrics are something you measure to understand if the intended outcome has been achieved.

Summary & What’s next

After reading the first essay, you should be able to put together the growth formula and growth model for your business idea. After reading this essay, you should be able to

build a visual metric hierarchy of your growth model,

identify the independent/input and dependent/output variables in it,

map the independent metrics to their respective business drivers, and thus the levers that will improve them, and finally,

visualize the growth team structure that corresponds to the independent metrics & associated levers.

In the next essay, we will close on the first section of the series, with steps to set up a continuous measurement system to track if the growth system is working as intended or not. It will also introduce a few key analytical concepts that further sections will build on.

The second section of the series, to be published in February, will go about answering the million dollar question: how do we gain enough cross-functional knowledge to know which levers will move the growth needle and which won’t?

If you have any suggestions on this article, or need any clarifications, I am reachable at sudhanshu@skilletal.com.

Very well articulated. I could visualise and relate to each of these. Everytime I am assigned a new domain or business area , this is the approach thats commonly followed to set up a predictable ecosystem.